CFGMS Underwriting Academy™: Build Your Own Portfolio

In the revenue-based financing industry, the CFGMS Underwriter Academy™ offers a valuable opportunity for aspiring underwriters. This program is designed to equip individuals with the

A revenue-based financing training program and fast track into a position with one of our underwriter teams

Learn with us, Fund with us.

Basic training before apprenticeship with underwriter team

Learn more about CFG Merchant Solutions®

(“CFGMS”)

Understand the process of underwriting a revenue-based financing from start to finish.

Gain insights into the economics of a transaction.

Learn how to quickly evaluate whether a deal is worth a risk review.

Understand how to properly price a deal.

How to generate a new funding from start to finish.

Build your own MCA portfolio, with unlimited compensation and earnings potential

Learn how to manage your portfolio.

Measure your wins and losses with the latest data tools.

Build your funding business.

CFGMS Underwriters have funded over $1 billion in MCAs since 2015

Senior Underwriter/Team Lead

Senior Underwriter/Team Lead

Underwriter

Underwriter

Underwriter

Underwriter

CFGMS has funded over 25,000 businesses across the U.S. We are an industry leader focused on providing working capital to American businesses who have traditionally been underserved by the big banks. At CFGMS, we can fund almost any file, and fund a ton of micro files less than $20K. Additionally, with competitive ISO compensation packages, our referral partners love working with us!

CFGMS finances thousands of units per month. At CFGMS, we never stop funding. Our total funds provided have eclipsed $1 Billion and continues to grow by the day! Underwriters at CFGMS enjoy the benefits of working with a funder who is invested in their growth!

Fill out the application form, and a CFGMS representative will reach out to you within 24 hours!

In the revenue-based financing industry, the CFGMS Underwriter Academy™ offers a valuable opportunity for aspiring underwriters. This program is designed to equip individuals with the

After completing the initial boot camp phase, dive into the next phase of the Underwriter Academy at CFG Merchant Solutions™ (CFGMS™): Apprenticeship & Mentorship. Led

CFG Merchant Solutions™ is excited to announce the launch of the CFGMS Underwriter Academy™ on May 1st. This program is designed to create a path into

The program is ideal for individuals interested in pursuing a career in underwriting, especially within alternative financing. It’s suited for recent graduates, professionals looking for a career change, or those with prior experience in finance, banking, or related fields.

Participants will gain:

Yes, participants in the CFGMS Underwriter Academy™ are compensated during their training period.

Applicants should have:

Submit an application: Complete the online application form on the CFG Merchant Solutions™ careers page.

Yes, participants who successfully complete the program may be offered a position as an Underwriter at CFG Merchant Solutions™, subject to performance and business needs.

Visit the CFGMS™ Careers page to learn more and submit your application.

For more information please reach out to info@cfgms.com.

On March 5th at 3:00 PM, CFG Merchant Solutions® will take center stage at Funders Forum as CEO Andrew Coon and President Bill Gallagher host a highly anticipated 45-minute fireside chat in the Terrace

Funders Forum Broker Expo, scheduled for March 4-6 at the Seminole Hard Rock Hotel & Casino in Hollywood, Florida. This event is of the most influential events in the

CFG Merchant Solutions® (CFGMS) is proud to announce the appointment of Patrick Connelly as an Underwriting Franchise Partner. This appointment reflects CFGMS’s continued investment in

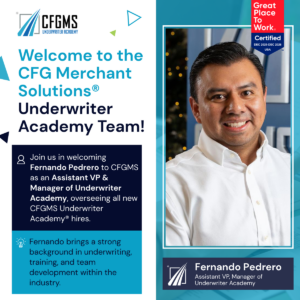

NEW YORK, NY, 2/19/26 – CFG Merchant Solutions® (CFGMS) is pleased to announce the addition of Fernando Pedrero as Assistant Vice President and Manager of

The SS4 form is one of the first and most important documents a business will complete when getting started. Whether you are forming a new company, hiring

When exploring financing options, you’ve likely come across the term collateralized. But what does it actually mean, and how does it impact your business? Understanding how collateralized funding works can help

CFG Merchant Solutions (CFGMS)® provides working capital to small and medium-sized businesses that are often underserved by traditional banks. We offer flexible and fast funding solutions to help businesses overcome cash flow challenges, seize growth opportunities, and navigate unexpected expenses.

CFGMS offers a primary working capital solution:

Revenue-Based Financing: A flexible funding option where repayments are based on a percentage of your future revenues, making it ideal for businesses with fluctuating cash flow.

Applying for funding with CFGMS is straightforward:

Partnering with CFGMS™ provides several advantages:

At CFGMS, we believe in the power of human interaction. Each client is assigned a dedicated representative who will guide them through the entire funding process. While we use technology to streamline certain steps, you’ll always have a real person available to address your questions, provide support, and ensure a personalized experience.