CFGMS Admin May 19, 2021 Categories: Equipment Financing, Invoice Factoring, Merchant Cash Advance, Small Business Funding, Working Capital Financing

It isn’t uncommon for businesses to experience a shortage of working capital, especially in today’s economic environment. Unfortunately, that same environment is making it difficult for businesses to obtain the working capital financing they need to promote growth and keep their operations on track and moving forward. Banks and other traditional lending institutions are tightening their belts on business loans as much as they did during the financial crisis of 2008.

That created a rise in the popularity of alternative funding among business owners, although some remained skeptical about it. Trying not only to survive but thrive in the current economic environment has caused those same business owners to reconsider alternative funding options. They need to bridge the working capital gap left behind by the Coronavirus and the spending restrictions of federal funding such as the Payroll Protection Program (PPP). While it is true that alternative funding can be a bit more expensive than obtaining a traditional loan, it’s better than the potential result of not securing funding – closing your business down permanently.

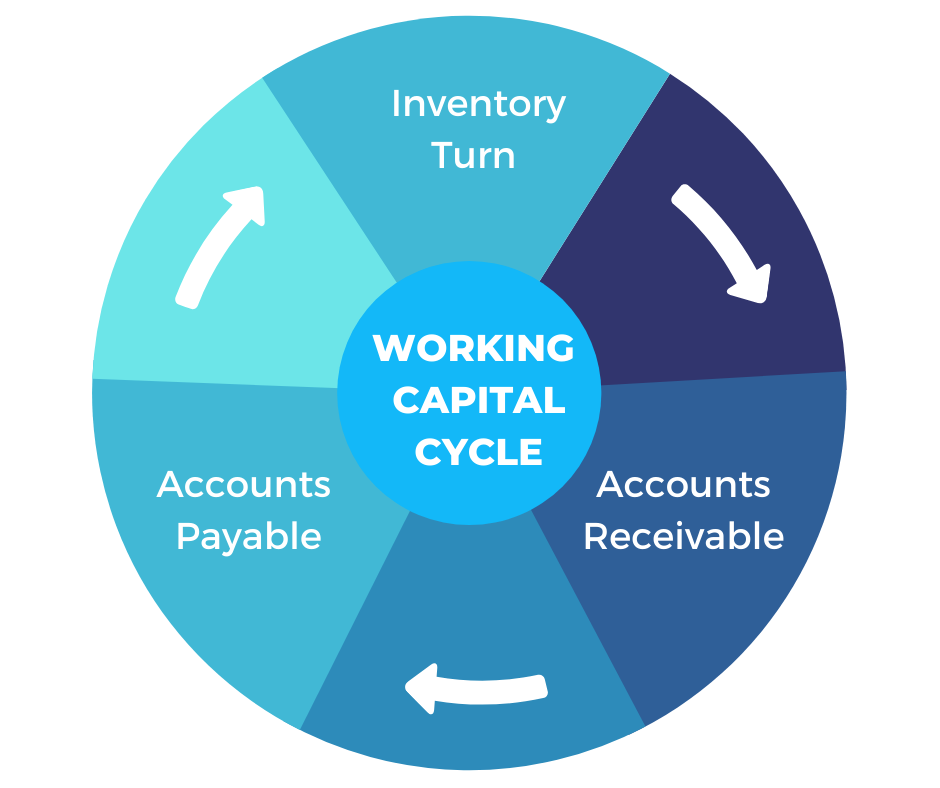

The Working Capital Cycle

This is the length of time it takes a business to convert its total net working capital into cash. Net working capital is defined as a company’s current assets minus its current liabilities. Businesses typically try to sell their inventory and collect payment from their customers quickly. They then pay their bills slowly to optimize cash flow. While it can vary depending on the industry, here is a basic example of how the working capital cycle works.

First, the company purchases the materials they need to produce inventory or provide services. The materials are purchased on credit with 90 days to pay and are considered accounts payable. Just before the 90 days is up, let’s say on day 80, the company delivers the finished goods or services. This is considered the inventory turn. Their customer now has 30 days to pay for those goods or services. This is considered accounts receivable and leaves a gap of 20 days before the company receives payment and the working capital cycle is complete. Of course, the effect of the Coronavirus often extended this gap as business fell off and customers were even slower to pay.

Benefits of Alternative Funding

Despite the fact that it is often more costly than traditional options alternative funding also offers a few advantages.

Fast Funding

When a business experiences a short-term gap in working capital, they need cash now. One of the best advantages is that working capital financing is that you can receive funding fast. It requires less paperwork than traditional financing and alternative funding providers use fintech to process applications quicker and more efficiently. The result is that you can be approved in hours and funded in days.

No Additional Debt

The last thing a business owner wants to do when experiencing a gap in working capital is to add debt to their balance sheet. With alternative funding options like invoice factoring or a merchant cash advance, you are not taking out a loan. You are simply receiving an advance on money this is or will be owed to you

No Collateral Necessary

To keep up with the competition, businesses often need new equipment. The upfront expense of purchasing that equipment can significantly diminish your working capital. Equipment financing allows businesses to purchase or lease equipment and make smaller payments over time thus protecting their working capital. With traditional financing, valuable business assets would have to be used as collateral. With alternative funding options like equipment financing, the equipment you are purchasing is considered collateral. This way you can get the equipment you need to remain competitive without the huge upfront expense or putting other valuable business assets at risk.

Perfect Credit Not Required

With many working capital financing options, perfect credit isn’t a requirement. Alternative funding providers do consider your credit score, however, they take a variety of other factors into consideration. With a merchant cash advance, your potential for future revenue is a primary consideration. With invoice factoring, you are selling your customers’ invoices to the factoring provider. Therefore, the customer’s credit history is reviewed, not yours.

Working Capital Financing with CFG Merchant Solutions™

To remain competitive and have your business survive tough economic times, maintaining healthy cash flow is crucial. CFG Merchant Solutions™ offers a variety of funding options to help preserve your working capital and keep your business on track. Whether it’s a merchant cash advance, invoice factoring, equipment financing, or any of our other funding options, we will guide you in choosing the perfect solution for your individual business needs. Our team brings to the table more than 60 years of institutional investment banking experience in the credit, commercial finance, and capital markets. Contact us or apply online today.