CFGMS Admin January 20, 2021 Categories: Business Tips, Small Business Funding

Many small businesses struggling to survive the ongoing economic crisis drew a sigh of relief when they heard there would be a second round of PPP loans. The Payroll Protection Program reopened for first draw loans on January 11th and second draw loans on January 13th, 2021. The SBA is currently accepting applications for the second draw PPP loans from participating lenders. Many small business owners who already received an initial loan probably all have the same question – are they eligible for this second round of small business relief?

Second Draw Qualifications

Businesses are typically eligible for a second PPP loan if they meet the following criteria.

- They previously received an initial PPP Loan and either has or will spend the full amount strictly for authorized uses.

- They have no more than 300 employees. This is down from the requirement of no more than 500 employees for the initial PPP loans.

- They experienced a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

According to the SBA, at least $25 billion is being reserved to issue second draw PPPloans to eligible businesses with a maximum of 10 employees or for loans of $250,000 or less to eligible businesses in low or moderate-income neighborhoods.

Loan Terms and Maximums

This second round of small business relief is subject to the same general loan terms as the first draw PPP Loans. The funding can be used for:

- Payroll costs, including benefits.

- Mortgage interest, rent, and utilities.

- Costs related to COVID-19 worker protection.

- Uninsured looting or vandalism property damage costs incurred during 2020.

- Certain supplier costs and expenses for operations.

Maximum second draw PPP loan amounts are based on 2019 or 2020 average monthly payroll expenses. For most businesses, the amount will be 2.5 times those expenses up to $2 million. For the Accommodation and Food Services sector, the maximum loan amount 3.5 times the average monthly 2019 or 2020 payroll expenses up to $2 million. NAICS72 should be used to confirm eligibility for this sector.

The borrowing business is responsible to present an accurate calculation of average monthly payroll expenses and attest to that accuracy on the application form. Participating lenders are expected to conduct a good faith, timely review of these calculations and supporting documentation of the borrower’s average monthly payroll expenses.

Second Draw PPP Forgiveness

Full forgiveness for this second round of small business relief is primarily the same as for the initial PPP Loans. During the 8 to 24 week period following receipt of a second draw PPP loan, businesses must adhere to the following guidelines.

- Employee retention and payroll expenses are maintained in the same manner as required for the initial PPP loan.

- PPP Loan funds can only be spent on payroll and other eligible expenses.

- A minimum of 60% of PPP loan funds must be spent on payroll expenses.

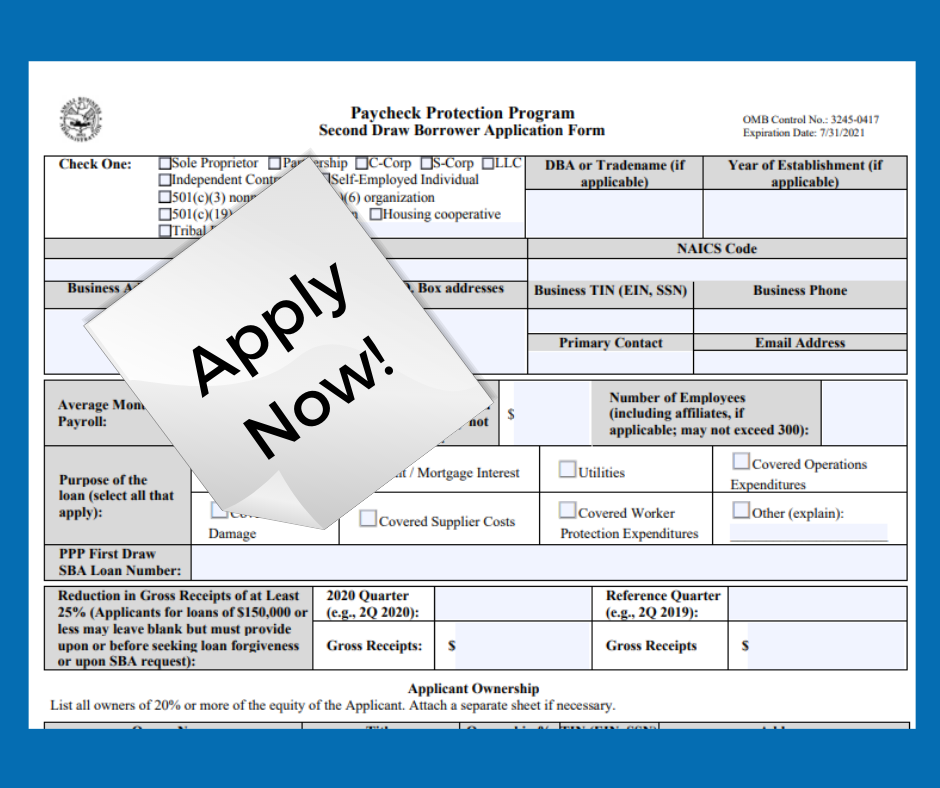

How to Apply

The window to apply for the second draw PPP loan closes on March 31st, 2021. If you are interested in receiving these small business relief funds, don’t hesitate. The sooner you apply, the sooner you will receive funding if eligible. You can apply using the SBA Second Draw Borrower application form.

Need Additional Small Business Relief?

Need funding to cover expenses outside of the PPP eligibility guidelines? Or you don’t qualify for a second draw PPP loan. CFG Merchant Solutions™ may be able to help. Our industry has experienced some constraints as a result of the pandemic. However, we continue to offer alternative business funding to qualifying small businesses. We offer a variety of funding options and our experienced team can help you determine which is the best funding solution for your business. Apply or contact us today.